Meridian Bank® has been highly successful in tailoring financing solutions to businesses across a broad range of industries. We bring that experience, along with our solid financial footing and reputation, to the business of Equipment Finance. Whether your needs are to finance, or provide financing, you can be sure that when you know Meridian, we’ll know you.

How we work

This business is about building and keeping, predictable, long-term relationships. You’ll know what we’ll do and what we won’t, while getting:

We’re experienced and excel in a range of industries including

Auto Body / Auto Repair

Construction

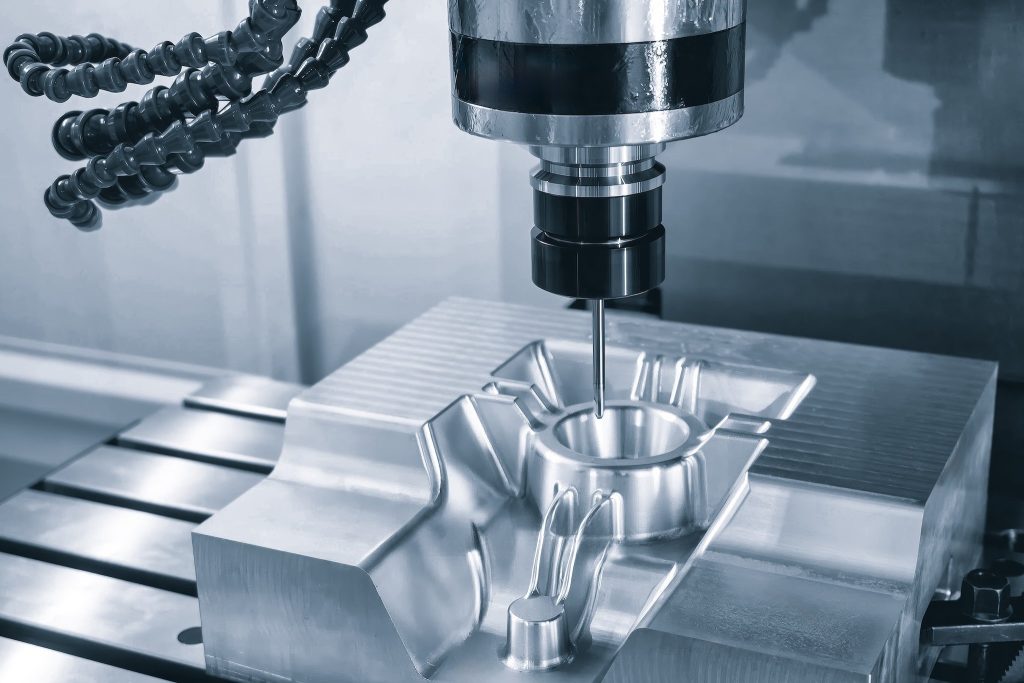

Fabrication

Healthcare – Medical, Dental, Veterinary

Landscaping

Manufacturing